Using the same recommendations given that a lot more than, you could potentially potentially qualify for a $66,000 mortgage having a five-season amortization, 9% interest, without almost every other expense otherwise dependents. When you have credit costs from $1250 a month, credit cards with a beneficial $5,000 limit and two dependents, plus loan price is 15%, its unlikely that you’re going to be eligible for additional credit.

Exactly how much financing must i log in to a 50,000 income?

A borrower that must pay back $1250 30 days to have present borrowing from the bank, which have that loan rate regarding 15%, a charge card restriction from $5000, and two dependents can potentially qualify for a loan away from $13,000. Should your debtor qualifies getting an increase regarding 9%, requires good four-year label, and also not any other borrowings otherwise dependents, capable possibly get a loan amount as much as $100,000.

Just how much loan must i log on to a good 100,000 salary?

That have an income off $100,000 per year, you can be eligible for financing of up to $100,000 either in problem listed above. The funds is enough to help a great four-season loan at the 9% with no personal debt repayment or dependents. With month-to-month financial obligation costs out of $1250, a good $5000 credit card limit, as well as 2 dependents shouldn’t effect credit it count.

Signature loans typically dont go beyond $100,000. In the event that a borrower desires much more, they ounts are examples simply. While you are interested exactly how much you could potentially borrow, you can make use of a personal bank loan calculator based on money. Locate a more particular count, you will need to know the way far you are currently using with debt installment. Loan providers possibly were other money that isn’t income-relevant, instance alimony or public safeguards. For those who have even more sources of earnings, be sure to tend to be people as well in the calculator. One of the best a way to determine how much you qualify to possess is always to view even offers at the Acorn Financing. At the Acorn Loans you have access to better federal lenders instead affecting your credit score.

Which loan providers offer money-situated personal loans?

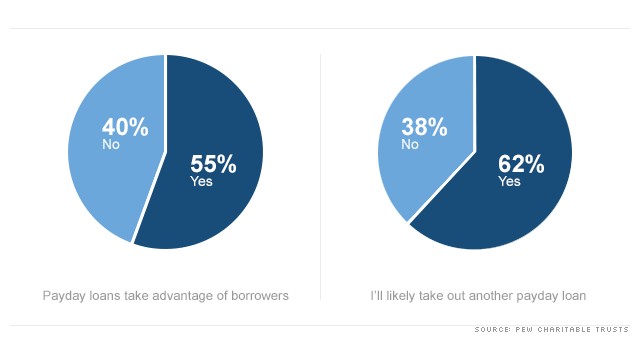

This will depend with the particular mortgage you are applying for and just how far you would like. Borrowing from the bank unions commonly put even more focus on income than simply into the good borrower’s credit history. They are able to supply payday option funds being brief figures that can assist a debtor cope with a hard time. On top of that, the prices on pay-day choice fund are usually capped during the 28%, causing them to an even more realistic choice than payday loans. Yet not, borrowing unions constantly just bring these types of services to professionals.

Most other lenders exactly who can create money-founded money is actually fellow-to-fellow lenders and you may firms that manage poor credit funds. Be sure to see the terminology, pricing, and you will charge in advance of accepting this type of fund.

What is an income-founded loan?

When loan providers see individuals, they imagine situations particularly credit rating, debt-to-earnings, a job, or other affairs. Inside antique approval techniques, credit score contains the biggest impression. That’s, unless you are looking for an income-depending mortgage. Income-situated funds try only centered on your income, thus causing them to perfect for crappy or no borrowing borrowers.

Payment terminology are typically flexible, and you may borrowers can decide while making costs with the a month-to-month otherwise annual base. Income-dependent loans was great for people that might not be eligible for old-fashioned funds.

Ought i get a loan that have poor credit but a good income?

A beneficial money are going to be a lifesaver when it comes to qualifying for a financial loan, especially having poor credit. Depending on how bad your borrowing from the bank is, you’ll be able to or might not be eligible for antique loans. Ahead of bouncing so you can money-created fund, you ought to see if you can qualify for traditional loans and do a comparison of which is a better price.