For folks who haven’t were only available in a house yet , and are seeking to check on the different streams off investment in advance investing this is the article to you personally. We have been deteriorating just what individual currency lending are, why somebody you are going to prefer personal credit, and the ways to safer loan providers. So as opposed to next ado let us jump in.

What exactly is Private Currency Lending?

Personal currency lending try a system where a debtor obtains financing off a private organization otherwise personal . They’re a beneficial due to the fact a fast substitute for discover funding because they don’t constantly belong to a similar degree process or analysis you to conventional bank loans bear.

Since they are not like your antique home loan, t hat does mean there is going to be additional chance involved that have getting an exclusive money lender otherwise borrowing from the bank individual currency. The way both the lender therefore the debtor can also be mitigate risks associated with personal money credit is:

Credit – The financial institution will look towards the borrower’s credit rating observe exactly how historic costs was in fact repaid. Did the borrower pay them back into a routine and you may quick style? If for example the answer is sure they’ve got a top credit score.

Costs – The lender is to make an effort to secure the price of the borrowed funds as effective as almost every other loan providers. If it is not competitive new debtor will in all probability go searching elsewhere to possess a far greater-valued mortgage. Sometimes individual loan providers will follow a similar rates of interest since the banking companies.

Definitely look at your regional state guidelines to be sure you are after the proper strategies regarding individual money.

Why would you use Individual Currency Financing?

There are various of various reason individuals can get prefer to utilize private financing versus a vintage mortgage. Let us walk through certain advantages and disadvantages regarding personal money lending.

Personal money financing can be a quicker-moving techniques than simply conventional loans. It is because it always with less limits and you can red tape to go through.

This can be an effective option for people who are only bringing started in home investing. For many who initiate wanting private loan providers it’s simple to remain a beneficial a great connection with them. Once you’ve accumulated a strong band of individual lenders they may probably money much of your sales.

Whenever choosing exactly how much so you’re able to lend while they have to give, all lbs of decision is dependant on the resource rather than the fresh borrower’s capacity to repay the mortgage. not, payment tend to nonetheless play a bit of a factor in it.

Interest-merely repayments is situational. That it hinges on that which you exercised with your personal bank if it’s a single or a place. Yet not, specific organization personal loan providers allows attention-merely payments in the repayment several months.

Personal money credit normally consider one thing including looking for people to contribute to the financial investments, or a team of visitors to invest thanks to a structured business.

This means they aren’t as the limited due to the fact old-fashioned lending features particularly when its a single. They may be much more flexible with lending terms and conditions or perhaps be able to change things out-of problem to help you problem.

A more impressive down-payment like other of almost every other deciding activities privately credit try situational. All this relies on your feel and the success of your own investment. Moreover it hinges on when you yourself have a personal mortgage off a small grouping of individual loan providers as the a place or an individual financial. Some lenders need a much bigger deposit if there is much more exposure a part of credit your money.

How will you see personal loan providers?

First, you will need to decide what types of personal money financing you really wants to venture into. Do you want one thing way more organization like a small grouping of loan providers which have a friends? Otherwise do you choose to pick a number of individuals to spend money on the other strategies?

Once you determine what approach you want to just take, you might formulate plans for getting the individuals individual lenders.

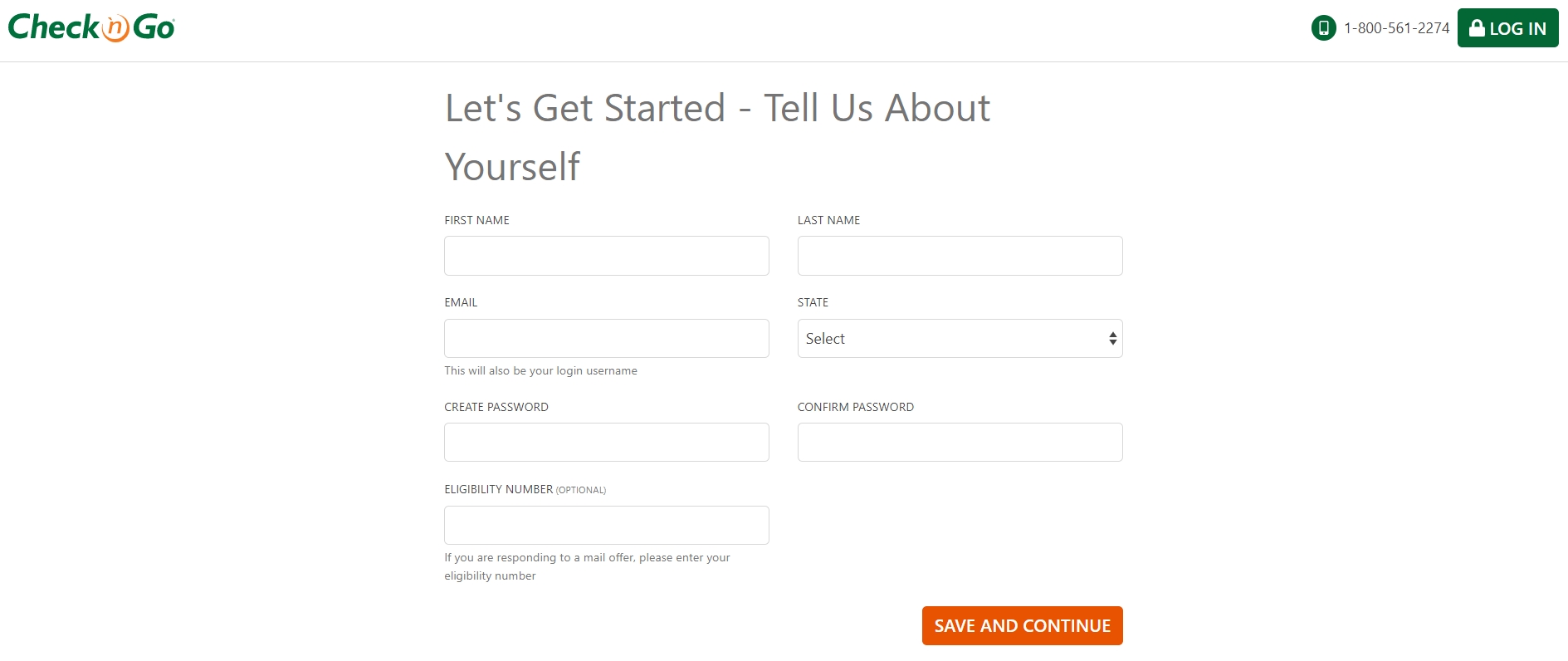

If you’re looking for lending enterprises one surefire treatment for locate them is to carry out an internet search for personal loan providers. Carry out an email list and commence reaching out to all of them. Uncover what the terminology try after they lend to those and https://paydayloanalabama.com/cardiff/ exactly how its process really works.

You should be shopping for loan providers which have passions you to dovetail that have your very own in that way you understand that you will be into an excellent comparable page with respect to sales. Think about personal financing just like the a business commitment in a few points.

You never know exactly who on your community might have been seeking to invest their money somewhere while would-be one of several some one it made a decision to dedicate compliment of. Be certain that you’re going to network incidents for real estate occurrences, as well as when you are marketing in other regions of your life you shouldn’t be timid to share with people you purchase actual estate.

Share with people. And that i mean men and women. Family of church, your kids’ sports incidents, any craft. They never ever affects to share with all of them you are a genuine home investor plus when they is almost certainly not in the status to provide an exclusive mortgage, they may understand people within community that will purchase. This is why networking is really a robust tool.

Contrasting Potential Loan providers

It is critical to to ensure that you see in case your lender are going to be most effective for you. Its not adequate merely once you understand they may be a lender. Which happens along with what i said prior to, remember all of them just like the a corporate partner. Would the viewpoints fall into line with a? Are they likely to follow-up to the pledges you make? Precisely what does the portfolio seem like?

Make certain he’s receptive. In the event the once you begin using them they don’t pick up your calls otherwise at the least return all of them that’s wii indication. You need an individual who could be involved on procedure specifically if you plan into the expenses much time-identity.

Achievement

Resource the a property income is as extremely important as the providing available and you may looking for men and women business while the in the place of funding its not quite a complete contract yet. Whether you are protecting money using old-fashioned credit avenues or searching into the best personal money I am hoping this article helped you gauge the top path on how best to see money the income. Make sure to get off us a remark if you want you to touch on protecting traditional finance off loan providers.

And additionally, check out the newest films below to see what some of the business experts assert about securing financing for your sales.