On the NACA financial, we offer zero advance payment, no settlement costs, and versatile requirements concerning the credit scores and income account.

Due to the fact a verified path to homeownership, NACA has assisted tens and thousands of parents in the securing its dream homes. Let’s dive to your how the NACA program may benefit your, for instance the certain NACA money conditions as well as the actions so you can secure the mortgage.

- What is NACA?

- NACA program standards

- NACA money conditions

- NACA programs

- Delivering an effective NACA mortgage

- NACA professional and you can drawbacks

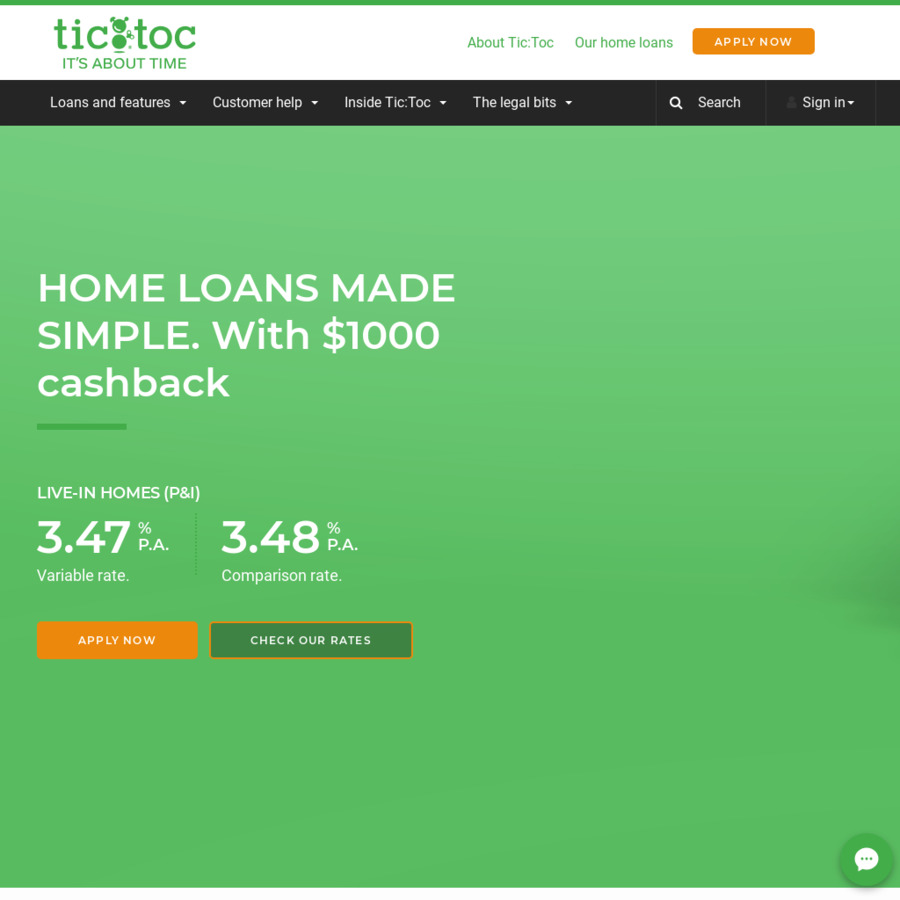

- Choices so you can NACA

- FAQ

What is the NACA system?

NACA, or perhaps the Community Advice Business from The usa, is a non-money company intent on financial justice as a consequence of homeownership and you will people advocacy. Their purpose concentrates on getting reasonable casing possibilities and you will monetary counseling to be certain individuals of all monetary experiences can find their fantasy home.

NACA has the benefit of some property software for both home buyers, home owners americash loans Yampa, and you may clients. Of these, the newest NACA House Get program, which is labeled while the America’s Most useful Financial, are an expert financing system made to promote available home loan alternatives with no financial difficulties typical out-of old-fashioned financing, like off payments and you will highest rates.

As opposed to really underwriting mortgages, NACA prepares their professionals having homeownership courtesy total counseling and you can an effective comprehensive app process. Members are after that combined with married finance companies that provide investment.

With this thought, the latest NACA program stands apart of antique home loan paths. Instead of prioritizing fico scores, they emphasizes the importance of a routine commission background along the past one year, such as timely lease costs. When you find yourself appealing people of most of the income mounts, new NACA program is particularly good for those getting below their area’s average income (AMI), giving unique NACA system standards that focus on lower- so you’re able to modest-money people.

NACA system requirements

Before making the fresh dive, folks who are shopping for the newest NACA property system must fully understand its standards and features. Simply because, to become eligible for this specific home buying recommendations program, candidates have to meet many NACA program conditions.

To help possible NACA people see what exactly is requested of these and you will the way they you will complement within the program’s criteria, the following is an intensive self-help guide to NACA program standards.

NACA income criteria

Brand new NACA program centers around assisting reduced to help you reasonable-money somebody go its dream about homeownership through providing mortgage loans that have sensible terms and conditions. In order to be eligible for an excellent NACA home loan, people need certainly to meet specific NACA money criteria that are based on the fresh area’s median earnings, family proportions, and property area.

People need to show that its earnings drops in the outlined supports giving in depth documents, such as pay stubs, tax returns, and you can financial comments. This course of action allows NACA to evaluate the stability regarding an enthusiastic applicant’s income and make certain he has got a professional economic resource to support homeownership.

NACA credit history

Rather, the program explores your own fee history along side prior one year. NACA desires note that you have consistently repaid their rent and most other personal debt on time within the last season.

NACA loans-to-income ratio

Typically out-of flash, your own overall month-to-month debt repayments, including your future mortgage payments, should not meet or exceed forty% in order to 43% of your own gross month-to-month money. This will be known as your debt-to-money proportion, otherwise DTI.

Including, should your pre-tax month-to-month earnings was $cuatro,000, their month-to-month homeloan payment needed to be $step one,240 or reduced getting entitled to brand new NACA program.

NACA financing limits

NACA finance do not go beyond the latest conforming mortgage maximum having a place. Within the 2025, the new limit to own an individual-house is actually $ in most areas and you may $ during the high-prices areas.