A no assessment home guarantee financing is a hybrid family security mortgage you to definitely individuals can apply getting without having to be an assessment from the property. This package gives residents find here a faster way to make use of its family equity without having any usual waits and you can will cost you out of authoritative appraisals. But not, no-appraisal home security financing are not very common.

Associated with simple: loan providers view it high-risk provide away funds as opposed to an appraisal. That they like old-fashioned appraisals to accurately measure the property’s worthy of, enabling all of them treat potential losses whether your borrower are unable to pay off the latest financing.

Having said that, i at the RenoFi was dedicated to providing property owners as you learn all their borrowing selection because of full guides like this one. In this article, we will coverage just how zero-appraisal family equity loans performs, whether or not you should know them, and other borrowing alternatives you may want to explore.

What exactly are No-Assessment House Security Money?

A no-assessment domestic collateral mortgage lets property owners borrow cash according to research by the security he has got in their land without needing a formal appraisal to determine the new residence’s worthy of. This financing is great for anyone who need brief bucks for domestic renovations, paying off debt, otherwise addressing unexpected expenditures.

Just how No-Appraisal House Collateral Fund Work

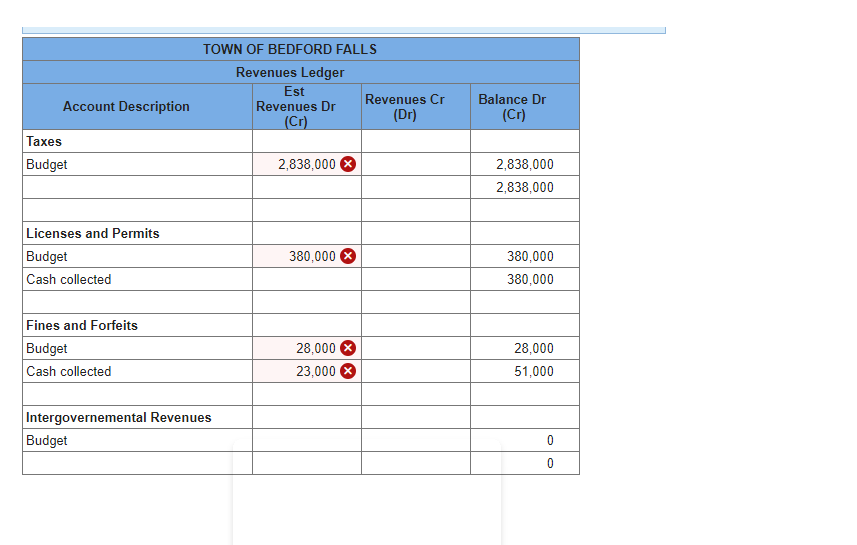

Without-appraisal household equity funds, lenders have fun with different methods to work out how much your property may be worth rather than going through a timeless appraisal. After you apply for the borrowed funds, the lender will check your credit score, earnings, and you may latest financial balance to see if your qualify.

Whenever you are lenders avoid using an official appraisal, they generally rely on different ways so you can estimate your own house’s value. Whether your estimated worth fits new lender’s conditions, they can agree the loan without needing an appraisal. Which simpler techniques means you earn recognized reduced and you can shell out lower settlement costs.

Bank Standards and you may Qualification Standards

If you are considering a zero-appraisal home guarantee mortgage, it is very important understand what loan providers generally get a hold of. When you are requirements may differ, listed below are some common activities that may apply at the eligibility:

Credit rating

Most loan providers like to see a credit score of around 620 or higher. Good credit suggests that you may have a substantial borrowing background as they are planning build your repayments timely.

Debt-to-Income Proportion (DTI)

Lenders commonly look at your DTI, and therefore compares the monthly loans repayments to the disgusting month-to-month money. A reduced proportion is perfect, because shows that you’ve got a workable number of personal debt.

Loan-to-Really worth (LTV) Proportion

After you apply for a no-appraisal domestic equity loan, loan providers look within LTV ratio. Which ratio measures up the full financial and you can house equity loan obligations for the residence’s well worth. Loan providers usually become safer if this ratio signifies that there is lots of guarantee in your property. This gives all of them reassurance, with the knowledge that the mortgage is backed by adequate worth on your own house.

Guarantee in your home

Having an abundance of guarantee of your property is actually extremely important since it helps offset the exposure to possess loan providers after they skip the formal appraisal techniques. The more security you’ve got, a lot more likely you are to locate accepted without needing an enthusiastic assessment.

Length of Homeownership

Just how long you have owned your residence may are likely involved. If you have possessed they for some time, you probably have more guarantee and you may a better likelihood of qualifying.

Amount borrowed

Essentially, faster mortgage wide variety was simpler to score instead of an assessment since they carry quicker chance into lender.

Money Verification

You will probably need offer proof of earnings, instance shell out stubs otherwise tax returns, to show you could repay the loan.