Land-in-Lieu Resource having a cellular Domestic

Now we shall explore just how home buyers are able to use homes due to the fact this new advance payment to their cellular family, an alternative known as Home-in-Lieu from the cellular house globe.

Over the last couple of articles i have gone over solutions getting homebuyers who do not even individual home and want to invest in both its land and family towards the that financial (read more with the the individuals alternatives here this is how).

But for those who currently individual its homes, the brand new belongings-in-lieu choice could be extremely tempting because eliminates the you want to create a giant cash advance payment.

The purpose of a downpayment

It’s very public knowledge that when you purchase property, you’ll need a down payment. Based many co-depending situations (credit history, earnings, amount borrowed, an such like.) a loan provider should determine the entire down-payment expected.

It will typically fall ranging from 5% and you may ten% of full household speed and additional house advancements getting rolling on mortgage.

Advance payment ‘s the proof of your own investment for the higher get you’re making. It might be simple for anyone to ask for that loan which have a good income and you can credit score if they didn’t have in order to indeed dedicate any one of her money into the buy by themselves.

But of the requirement of a personal money, not only really does the lending company features one thing to treat in the matter of foreclosures, however the family-owner does as well-the fresh new several thousand dollars produced when the household was bought.

With residential property-in-lieu money, in place of yours financial support regarding the financing are a profit lump sum, you are alternatively investing together with your land.

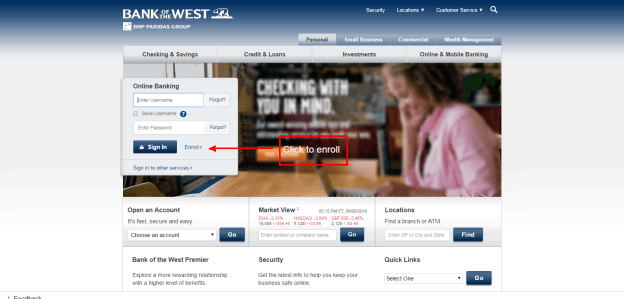

As with any mortgage, the process begins with a free of charge borrowing from the bank app. Your own casing agent have a tendency to make suggestions by this, assisting you structure the program to offer their result in lieu regarding a down-payment.

As recognition comes back, very often the menu of all documentation wanted to go-ahead with the closing desk. The lending company will ask for factors such as the action in order to the newest land to show possession, a current income tax document that presents the fresh taxation appraised really worth, paystubs, W-2’s, and other financial issued versions and you may waivers.

Just after this type of data had been processed and you will eliminated by financial, it could be time for you buy both assessment to the homes and what’s named a beneficial name lookup.

A title team often check out the property and home owners in order to ensure there aren’t any a fantastic liens or decisions with the land to own outstanding taxation. In the event the unpaid fees are observed, might need to be reduced at closure having bucks of the newest borrower.

In the event your borrower are unable to afford to repay brand new an excellent taxation, this new home are not available because the a down payment one offered and could result in the family customer to shed the latest recognition to their loan.

In most cases, when an area-manager enjoys a common identity, the term search can display the taxation which might be another person’s. In these instances, a great different people affidavit is signed in addition to user’s label could well be cleaned out-of people liens.

The fresh new Drawback off Homes-in-Lieu

Something to keep in mind if the choosing to bring the belongings just like the an advance payment when selecting a cellular domestic, is that as opposed to for the an effective chattel mortgage (money your house only), the lender commonly, if there is property foreclosure, individual both the belongings and you may house together.

While the land ‘s the personal capital, or collateral, found in procuring the mortgage, it is very important keep in mind that brand new lien could well be to your the house and you can assets to one another during the loan.

This one could be extremely very theraputic for homebuyers just who cannot produce the currency you’ll need for this new advance payment with the purchase of their cellular household nevertheless they also needs to see the potential chance of shedding not merely their home, nevertheless the full funding of their land as well.

A different possible disadvantage has the home appraise at under just what lender requires getting a down-payment. In this situation you would have to produce the difference between cash and you can could have both their house and money spent into the the newest mobile financial.

For the flipside, although not, house normally really worth over the bottom 5% requirement and can allow domestic client a high mortgage recognition, letting payday loan Bogus Hill them fund high priced property developments (utilities, porches, skirting) towards loan, that they may keeps if you don’t become not able to manage.

As with any mortgage, discover benefits and drawbacks is weighed, and it’s really crucial that you see the complete extent of your partnership you will be making because the a house buyer.

A skilled houses agent with your future success because property-proprietor planned can make it easier to restrict your options and help you stick to the financing which makes many brief and you can a lot of time-identity financial experience available.