Closing costs adds up, therefore shop around to find the most reasonably priced. The good-faith imagine (GFE) is to identify all of your settlement costs.

So is this a difficult Credit score assessment?

A difficult credit assessment, or inquiry, can also be briefly lower your credit history. It is different from a smooth inquiry, which doesn’t apply to your own get. While researching mortgage lenders, confirm whether these are generally using a mellow inquiry to pre-qualify your to possess a speeds. After you favor a mortgage lender, it does more than likely perform a painful credit assessment and then make a beneficial last provide.

Some loan providers check your borrowing the next big date, before closure. Should your credit rating keeps decreased, it could derail the brand new closing. View whether or not there’ll be yet another credit remove, and prevent bringing any tips that might affect your credit score up until the closing day.

Perform I must Indication The fresh new Documents really?

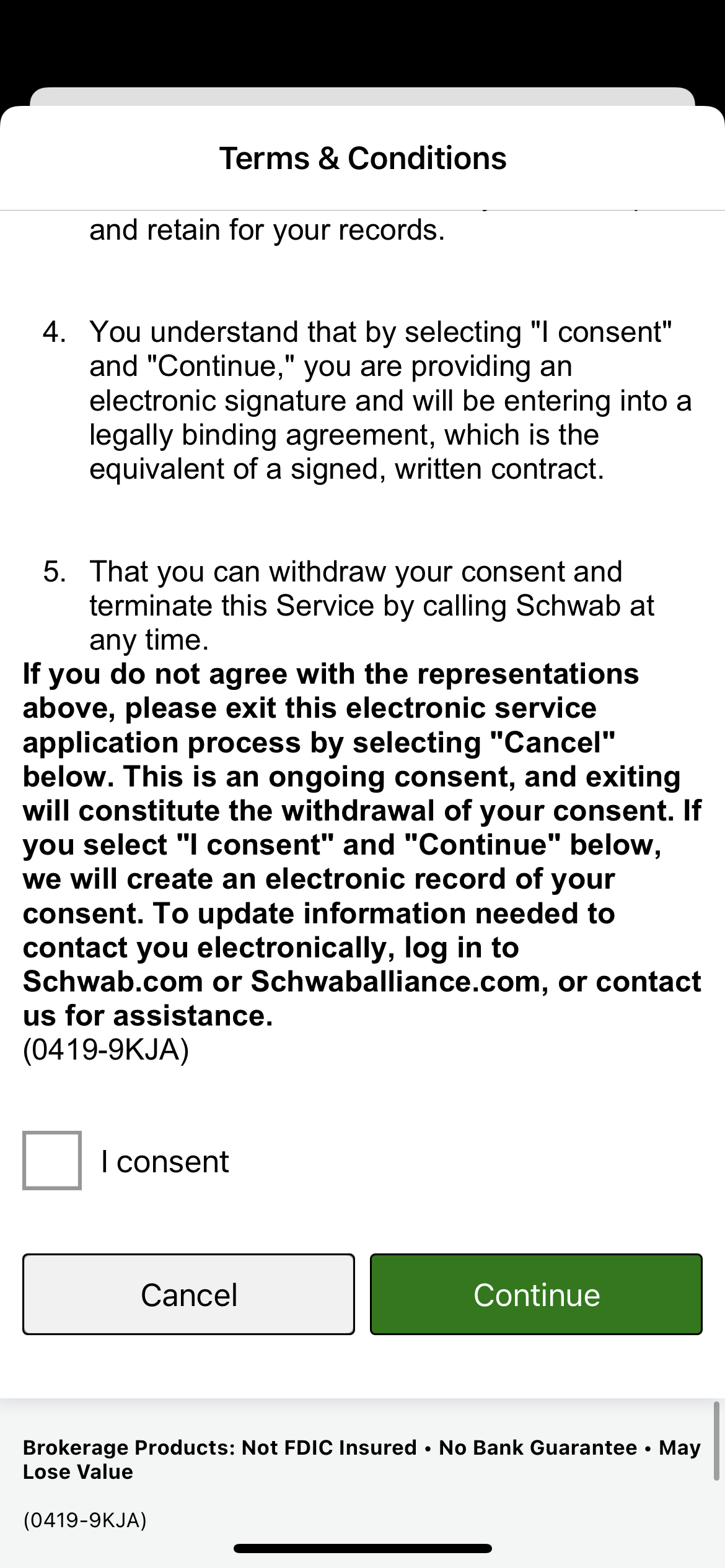

Confirm the method to possess closure on your family. Particular lenders give you the choice to romantic the borrowed funds digitally. If that’s the case, the alarmed events uses a secure digital process to indication documents and you may perform the deal. If you aren’t signing the latest data digitally, understand in which you need meet in order to signal the newest documentation. In either case, be certain that exactly what data files and operations are required ahead of time.

If you are not available to the fresh new closure documents, it will delay your capability accomplish the order and you can flow into the domestic.

How much time Does it Grab Before Mortgage Closes?

See how a lot of time the fresh new closure procedure is expected to take. Occasionally, closing can be relatively small, whilst in someone else, it takes several weeks. Confirm and that files you need to disperse the method together. Quicker you could potentially romantic, quicker you can aquire your house, therefore the reduce steadily the opportunities you to one thing will go wrong.

Which kind of Mortgage Is perfect for Myself?

Before deciding into that loan, talk about the options together with your mortgage lender otherwise a large financial company. The bank can help you view your position and you will contrast more alternatives, particularly a fixed-rates home loan in the place of you to with a varying price. Which have a predetermined speed, you have the exact same rate of interest and you will commission on the financing. Having a varying rate, you will get a lower rate of interest today, but there’s a chance that your interest tend to escalation in the near future, together with your payment. Glance at the positives and negatives together with your financial before generally making a decision.

Show their payment together with your bank. You might like to have a keen escrow account, which the lender otherwise mortgage servicer use to invest property owners insurance coverage money and you can property taxes. In cases like this, their payment could be more than it could was indeed with only their prominent and you will attract. When the escrow isn’t inside, you will have to generate separate plans getting insurance coverage and you can income tax repayments to get rid of fees and penalties or any other punishment.

Just how Will i Be Current on the Mortgage’s Advances?

There are various amount of financial techniques, regarding pre-approval so https://paydayloansconnecticut.com/northford/ you can recognition to help you closure, and you will probably need to make sure you’re on song. Discover what strategies the mortgage financial use to store you informed of your own loan’s advances. Be sure you likewise have the fresh new contact info of someone you could potentially consult with for those who have inquiries.

Inquire about this new downpayment. Certain loan providers have fun with apps that allow you to put down 3% and others require a whole lot more. You might like to qualify for financing, including the Va mortgage or USDA financing, which do not want a deposit whatsoever. When you have less credit score, you might need a bigger advance payment.